Services

The license application process would commence following the submission of a letter application together with a complete set of prescribed forms and supporting documents as well as a prescribed fee. The Securities and Futures Commission (“SFC”) would examine, inter alia, the business plan, compliance functions, financial status as well as other aspects of the proposed Licensed Corporation and its proposed regulated activity. The Substantial Shareholders and Responsible Officers of the Licensed Corporation would need to be satisfied that they are fit and proper persons. The SFC would send a letter to the applicant formally accepting the application following a preliminary review of materials received; however, it may often require submission of additional information and/or clarification of certain key issues identified prior to formally accepting the application. Depending on the completeness and quality of the information submitted and whether the SFC has particular concerns regarding the application, the licensing process would take approximately 4-6 months, or even longer depending on a number of factors such as the complexity of the issues which may be raised and the number of applications that the SFC is processing at any particular time.

Types of regulated activity

Schedule 5 to the SFO stipulates 13 types of regulated activity and provides a detailed definition for each of them. These activities are:

- Type 1 Dealing in securities

- Type 2 Dealing in futures contracts

- Type 3 Leveraged foreign exchange trading

- Type 4 Advising on securities

- Type 5 Advising on futures contracts

- Type 6 Advising on corporate finance

- Type 7 Providing automated trading services

- Type 8 Securities margin financing

- Type 9 Asset management

- Type 10 Providing credit rating services

- #Type 11 Dealing in OTC derivative products or advising on OTC derivative products

- #Type 12 Providing client clearing services for OTC derivative transactions

- Type 13 Providing depositary services for relevant CISs

# Not yet in operation for licensing purposes.

For setting up of the corporation from scratch, some major preparation items are listed below:

- establishment of a Hong Kong private limited liability company (“HK Co”)

- opening of a bank account

- sourcing suitable responsible officers (at least two responsible officers are required for each regulated activity) and assessing their fitness and properness to supervise the proposed activities

- preparation of a compliance manual, a business plan, a financial projection plan and other policies and documents

- securing premises for the HK Co

- compiling all relevant materials for the licensing application (including forms and supplements regarding proposed responsible officers and substantial shareholders)

- submitting the licensing application to the SFC (including the application for approval of the proposed responsible officers)

Compliance First provides thorough and practical HKSFC licensing application support services to assist corporations and individuals that seek to enter the securities and futures markets of Hong Kong and obtain the SFC license.

Our licensing team has handled over 400 license applications for the Corporations which are seeking to conduct Types 1,2,3,4,5,6,7,8,9 and 10 regulated activities in Hong Kong and their employees to obtain necessary SFC licenses for their businesses.

What Our licensing team will do?

- Assess qualifications and resume of potential Responsible Officers

- Advise on corporate structure and business plan

- Prepare and submit license applications

- Liaise with SFC case officers on application matters

- Handle SFC correspondences and requisitions

- Negotiate licensing conditions of the proposed Licensed Corporations

- Prepare compliance manuals and other necessary documents for license application

- After Submission: Provide support on enquiries raised by the SFC and handle the follow-up questions raised by the SFC.

If you have any more questions or need further details on any aspect of compliance support services, or license application services, please feel free to email us info@compliancefirst.com.hk to get quote.

After the License is granted – Compliance First can provide Continuous support after License is granted to assist our clients in complying with regulatory obligations/ reporting on an ongoing basis.

The scope of ongoing compliance support services for a Hong Kong Securities and Futures Commission (HKSFC) Licensed Corporation typically includes a range of activities to ensure adherence to regulatory requirements. We offer continuous compliance support to help Licensed Corporations and individuals fulfill their licensing obligations. Our compliance support services are tailored to provide high-value, problem-solving solutions that meet specific compliance needs, including:

- Regulatory Updates: Providing regular updates on changes in HKSFC regulations and guidelines that may impact the Licensed Corporation.

- Compliance Monitoring: Conducting periodic reviews to ensure that the Licensed Corporation’s operations align with regulatory requirements.

- Policy and Procedure Review: Reviewing and updating compliance policies and procedures to reflect current regulations and best practices.

- Training and Education: Providing training to our clients on compliance requirements and best practices to promote the culture of corporate compliance within the firm by way of Compliance First’s self-developed Mobile Application at Google Play or by monthly conference calls.

- Record Keeping: Assisting in maintaining accurate records and documentation to demonstrate compliance with regulatory requirements.

- Trigger Events Reporting: Preparation and submission of required reports to the HKSFC in a timely and accurate manner such as Change of key personnel, Financial Status Changes, Regulatory Breaches, Litigation or Disciplinary Actions, Material Business Changes, Suspicious Transactions, Technology or Cybersecurity Incidents and Client Complaints etc.

- Investigations and Remediation: Conducting investigations on compliance issues, as well as implementing remediation plans to address any identified deficiencies.

- Regulatory Liaison: Acting as a bridge between the Licensed Corporations and the HKSFC for inquiries, inspections, or audits, etc.

- Advisory Services: Providing guidance on complex regulatory issues, interpretations, and emerging trends in the regulatory landscape.

- Unlimited telephone and email consulting: We offer unlimited access to compliance experts via telephone and email, providing prompt responses to regulatory, operational, and compliance-related queries. This service ensures that firms and individuals receive timely guidance on regulatory requirements, policy interpretations, and best practices to maintain compliance.

- Monthly compliance conference calls: We conduct regular compliance discussions through scheduled monthly conference calls. These calls serve as a platform to discuss recent regulatory updates and their implications, address compliance challenges and best practices, provide training on emerging compliance issues, answer any compliance-related questions from clients.

These sessions help firms stay proactive and well-prepared for regulatory developments.

- Review of Financial Resources Return (FRR): We assist in reviewing the Financial Resources Return (FRR) based on the client’s management accounts, ensuring proper formulation and reporting of financial resources returns, compliance with liquid capital adequacy requirements, identification of potential financial risks, accuracy and completeness of regulatory submission.

This service helps clients minimize errors and avoid potential regulatory scrutiny or penalties.

- Completion of Business & Risk Management Questionnaire (BRMQ): We provide support in completion of the Business & Risk Management Questionnaire (BRMQ) which involves in the Licensed Corporation’s business operations and governance framework, Risk management policies and procedures and Internal controls and compliance frameworks. This is a compulsory submission to HKSFC along with the Audit Report.

- AML/KYC name search services using Dow Jones database: We conduct AML (Anti-Money Laundering) and KYC (Know Your Customer) name searches using the Dow Jones database, a trusted source for screening high-risk individuals and entities. This service include screening clients and counterparties against global sanctions, watchlists, Politically Exposed Person lists, and adverse media reports; identifying potential financial crime risks and ensuring compliance with AML regulations and due diligence requirements.

This proactive approach helps Licensed Corporations mitigate reputational and regulatory risks associated with financial crime.

- Handling of regulator correspondence and inquiries: We assist firms in managing communications with regulators, including responding to regulatory inquiries, notices, and requests for information; preparing and submitting compliance reports; addressing concerns raised by regulators and maintaining proper documentation of regulatory interactions.

Our support ensures that Licensed Corporations handle regulator communications efficiently and professionally, reducing the risk of misunderstandings or compliance breaches.

- Ad hoc compliance advice and assistance: We provide on-demand compliance advice on various regulatory and operational matters, such as: Interpretation of regulations and guidelines, Development of internal compliance policies and procedures, Assistance with regulatory filings and reporting obligations and Support during regulatory inspections and audits.

This flexible service ensures that firms receive timely and practical compliance guidance tailored to their specific needs.

The specific scope of services can be customized based on the needs and size of the corporation, the nature of its operations, and the complexity of regulatory requirements it faces. It is important of Compliance First to work closely with our clients to tailor the services to the corporation’s specific compliance needs.

It is essential for HKSFC Licensed Corporations to stay abreast of regulatory reporting requirements and ensure timely and accurate submission of reports to avoid penalties or regulatory action. Working with Compliance First can help in navigating these reporting obligations effectively.

If you have any more questions or need further details on any aspect of compliance support services, or license application services, please feel free to email us info@compliancefirst.com.hk to get quote.

On 20 August 2021, the SFC issued the Consultation Conclusions on the Management and Disclosure of Climate-related Risks by Fund Managers. The Consultation Conclusion set out by the SFC is to implement the recommendations using a two-tiered approach; a baseline set of requirements which will apply to all fund managers managing collective investment schemes; and a set of “enhanced requirements” that will apply to fund managers with assets under management (AUM) that are equal to or above HK$ 8 billion (excluding the AUM of discretionary accounts).

The SFC proposed that the Fund Manager Code of Conduct (FMCC) to be amended to provide high-level principles and that a circular be issued to set out expected standards for complying with the FMCC. Consequently, this new regulation will materially impact governance, investment and risk management, conduct, and reporting for more than 1,800 Hong Kong-based Asset management firms.

The asset management industry has been under pressure to manage its climate risk exposure. The Consultation Conclusion is a sign of convergence between institutional investor demands and the regulatory agenda.

For Baseline Requirements (applicable to all fund managers):

- Assess readinessfor climate risk integration in line with SFC requirements

- Identifygapswithin existing climate management approach and develop improvement plans

- Develop roadmapand/or action plan to ensure compliance by the effective date

- Establish climate-related governanceprocess and/or integrate climate issues into the existinggovernanceframework, internal controls and processes

- Develop or enhance the existing investment policy to integrate climate issues

- Determine the relevanceand materialityof climate risk to investment management

- Perform climate-related risk assessment of current portfolio and implement tools to systematically assess climate risk of future investments

- Develop climate-related disclosuresandreportingpackages to fund investors to fulfil SFC’s new climate-related disclosure obligations

- Provide on-demand trainingsessions to upskill organization-wide climate capability

For Enhanced Standards (applicable to large fund managers):

- All the areas covered in the baseline requirements

- Develop Engagement Policy on climate-related risks

- Advise enterprise-based value and forward-looking metrics for risk quantification

- Determine the available data sources and calculation of portfolio carbon footprint metrics

- Plan and conduct climate scenario analysis and analyse climate risk impact with consideration of asset classes, sectors, geographies and investment horizon to inform investment strategy and risk management

If you have any more questions or need further details on any aspect on Climate Risk Management and disclosure, please feel free to email us info@compliancefirst.com.hk to get quote.

Family Office, requires a license or not?

The SFC strives to perform its gatekeeping role in the Hong Kong financial markets in an efficient, transparent and consistent manner.

In general, a single-family office is not required to apply for a licence under the Securities and Futures Ordinance (SFO) if it does not carry on a business of regulated activity in Hong Kong. For example, the family office runs on a cost recovery basis (i.e., no income other than reimbursements of operating costs) or does not pursue profit as its objective.

It is not the SFC’s intent to extend its regulatory oversight to these single-family offices. However, a multi-family office is more likely to require a licence under the SFO as it usually operates as a commercial entity. The type of licence required depends on the services that the family office provide in Hong Kong.

Does your family office require a licence under the SFO?

Whether a family office is required to be licensed under the Securities and Futures Ordinance (SFO) is determined by reference to three key factors, all of which must be present to give rise to a licensing obligation:

- the services provided by the family office constitute one or more types of regulated activity;

- the family office is carrying on as a business; and

- the business is conducted in Hong Kong.

There are two relevant carve-outs from the licensing requirements for asset managers under the SFO:

- services provided solely to the group company (on a wholly owned basis) in respect of the group’s assets; and

- activities incidental to the trust service of a registered trust company under the Trustee Ordinance.

Single-family office

A single-family office arrangement, established to serve the investment needs of members of a single family, which is not being run as a business (for example, it only receives reimbursements of operating costs from the family) or does not pursue profit as its business objective, shall not be considered in ordinary circumstances as carrying on a business from a licensing perspective.

For regulatory purpose, the SFO has not defined family, family office and what relationships of blood or of law would constitute family membership. Thus, a single-family office:

- may serve non-family members without the need to be licensed; and

- can have more flexibility in determining its legal form and operational structure with respect to the services it provides.

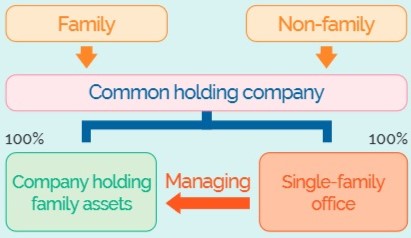

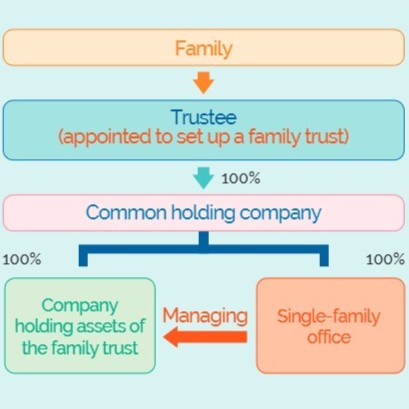

Ownership structure

Below are examples of ownership structures of single-family offices which do not require a licence under the SFO.

- A company wholly owned by another company which is held by family and non-family members

- A company wholly owned by another company which is wholly owned by a trustee appointed by the family to set up a family trust

The sharing of office premises and administrative infrastructure by two or more family offices would not automatically trigger a licensing obligation.

Multi-family office

A multi-family office, by definition, serves more than one high net-worth family. It is typically established and is run as a commercial venture. Thus, it is likely required to obtain a licence under the SFO before providing services in Hong Kong.

It is common for a multi-family office to obtain the following types of licences under the SFO:

- Type 1 (dealing in securities)

- Type 4 (advising on securities)

- Type 9 (asset management)

If the family assets include futures or option contracts, it may also need licences for:

- Type 2 (dealing in futures contracts)

- Type 5 (advising on futures contracts)

If you have any more questions or need further details on any aspect on Do you need any licence for Family Office, please feel free to email us info@compliancefirst.com.hk to get quote.

SFC has strict guidelines on how financial products and services are marketed to ensure fairness, transparency, and investor protection.

Key Areas to Review Based on SFC Requirements

When reviewing marketing materials for compliance with SFC regulations, consider the following:

Accuracy and Truthfulness

✅ Ensure that all statements, claims, and comparisons are accurate, fair, and not misleading.

✅ Avoid exaggerated performance claims or misleading risk disclosures.

✅ Clearly distinguish between fact and opinion.

🔴 Example of Non-Compliance:

“Guaranteed high returns with minimal risk!” → This is misleading unless explicitly backed by facts and regulatory approval.

Risk Disclosure

✅ Clearly disclose all relevant risks associated with the product or service.

✅ Use simple language that is understandable to the target audience.

✅ If past performance is mentioned, include a disclaimer such as:

“Past performance is not indicative of future results.”

🔴 Example of Non-Compliance:

- Mentioning only potential gains without discussing the risks.

- Using small fonts or hidden disclaimers that are ineligible to read.

Regulatory Approval & Licensing

✅ Clearly state whether the firm and the product are licensed or approved by the SFC.

✅ Ensure that all representatives mentioned in the material are licensed individuals under the SFC.

✅ Avoid any implication that SFC approval guarantees the quality or safety of the product.

🔴 Example of Non-Compliance:

“This product is SFC-approved, meaning it is 100% safe for all investors!”

- The SFC does not endorse or guarantee investment products.

Proper Use of Disclaimers

✅ Clearly include all necessary disclaimers as required by the SFC.

✅ Ensure disclaimers are compiled in a language which is easy to understand and legible (not in small, unreadable text).

✅ If the product is complex (e.g., derivatives, structured products), include additional disclaimers about suitability for investors.

🔴 Example of Non-Compliance:

- Placing disclaimers in tiny fonts or hidden sections.

- Not including the required risk warnings for funds, structured products, or derivatives.

Fair Presentation of Performance Data

✅ If performance data (e.g. past returns) is included:

- Use standardized time periods (e.g. 1 year, 3 years, 5 years).

- Clearly state whether figures are net or gross of fees.

- Provide benchmark comparisons if applicable.

✅ If hypothetical or back-tested data is used, it must be clearly labeled and explained.

🔴 Example of Non-Compliance:

“Our fund has outperformed the market every year!” without showing supporting data or proper benchmarks.

Suitability & Target Audience

✅ Ensure the content is suitable for the intended investor audience (retail versus professional investors).

✅ If a product is not suitable for retail investors, this must be clearly stated.

✅ Avoid over technical language that may mislead retail investors.

🔴 Example of Non-Compliance:

- Marketing complex derivatives to retail investors without proper risk disclosure.

Social Media & Digital Marketing Compliance

✅ Social media posts must follow the same compliance rules as traditional marketing materials.

✅ Any testimonials, endorsements, or influencer marketing must be clearly disclosed.

✅ Avoid clickbait or exaggerated headlines that may mislead investors.

🔴 Example of Non-Compliance:

- Using influencers to promote investment products without proper risk disclaimers.

- Posting misleading performance snapshots without context.

If you have any more questions or need further details on any aspect on Marketing Materials, please feel free to email us info@compliancefirst.com.hk to get quote.

OTC derivatives introduction arrangement under ISDA master agreement – Dealing with group affiliates and other connected persons

Referring to the paragraph 20.2, Code of Conduct issued by SFC, soliciting or recommending clients to enter into OTC derivative transactions with a group affiliate, or arranging for OTC derivative transactions to be entered into between a group affiliate and clients:

Note 1: A licensed person is exempt from the provision set out in paragraph 20.2(b) if the client is a Licensed Corporation, an Authorized Financial Institution, or a corporation similarly regulated as an OTC derivative dealer or a bank in a comparable OTCD jurisdiction.

Note 2: Transitional period in respect of existing client facing affiliates which fall outside the range of regulated persons set out in paragraph 20.2(b) (“Transitional Period”): The provision set out in paragraph 20.2(b) does not apply to solicitation, recommendation or arrangement related to an existing client facing affiliate which falls outside the range of regulated persons set out in that paragraph until the date immediately after the end of the transitional period for Type 11 regulated activity (as defined in section 1 of Part 1 of Schedule 11 to the SFO). An existing client facing affiliate means a group affiliate which has an ongoing introduction agreement with a licensed corporation within the same group that was established and in effect before 12 December 2018 whereby the licensed corporation agrees to introduce clients to enter into OTC derivative transactions with it. During the Transitional Period, Licensed Corporations should implement reasonable measures to protect clients from conduct and prudential risks of existing client facing affiliates which fall outside the range of regulated persons set out in paragraph 20.2(b).

If your firm was not licensed before December 12, 2018, and you have doubts about entering into an OTC introduction arrangement, please feel free to email us at info@compliancefirst.com.hk to request a quote.

Application for a Money Lender’s Licence and its renewal

In Hong Kong, money lending business must obtain a Money Lender’s Licence under the Money Lenders Ordinance (Cap. 163). Below is a step-by-step guide to the application process.

With effect from 3 October 2016, all applications for money lenders licences or renewal of licences submitted to the Companies Registry must be accompanied with the relevant supplementary information sheets in addition to the application documents.

Eligibility Requirements

To apply for a Money Lender’s Licence, the applicant must:

- Be a company incorporated in Hong Kong or a registered non-Hong Kong company.

- Have a physical business address in Hong Kong (a virtual office is not acceptable).

- Ensure that all Directors and Responsible Officers are fit and proper persons.

- Comply with anti-money laundering and counter-financing of terrorism (AML/CFT) obligations.

Fit and Proper and Premises Requirements

The Money Lenders Ordinance (Cap. 163) specifies the factors that the licensing panel shall consider in processing an application for a Money Lender’s licence. The factors include:

(i) whether the applicant is a fit and proper person to carry on business as a Money Lender (e.g. the

general knowledge, qualification and experience in relation to money lending business etc.)

(ii) whether the premises to which the application relates are suitable for the carrying on of the

business of Money-lending (e.g. usage of the premises and permission from the landlord and

tenant etc.); and

(iii) whether the grant of such licence is contrary to the public interest.

To facilitate the investigation to be carried out in respect of an application for the purposes of

determining whether, in the opinion of the Commissioner of Police (CP), there are grounds for

objecting the application in accordance with the Money Lenders Ordinance, the CP may require the

applicant to produce the following documents for processing the application:

Required Documents | Contents |

Documentary proof to support the applicant’s capability in managing the money lending business | Reference letter of previous working experience in money lending business, relevant certificate, etc. (Resumes are not accepted). |

Documentary proof to show the financial situation of the applicant | Bank statements of the company, directors or shareholders. |

Tenancy agreement | Tenancy agreement for premises intended to be used for money lending business. |

General permission from the landlord | Written consent from landlord and tenant, if the premises is sublet, for the intended use of premises for money lending business. |

“Permit to occupy a new building” issued by the Buildings Department | Specifying the use of premises for “office” or “shop” purposes. If the permit does not allow the use of premises for the above purposes, permission from the Buildings Department, District Lands Office and/or Town Planning Board for the change of use is required. |

Land Register obtained from the Land Registry by conducting land search | Specifying the ownership of premises. |

Floor plan inside the premises | Showing the partitions and equipments inside the premises. |

Annual return if the applicant is a company | Showing the directors and shareholders of the applicant. |

Application Process

Step 1: Prepare Required Documents

Applicants must submit the following documents:

- Application Forms

- Business Registration Certificate

- Certificate of Incorporation (if applicable)

- Director’s and Shareholder’s Information

- Business Plan & Operational Details (including lending policies and AML procedures)

- Premises Details (proof of business address)

- Audited Financial Statements (if applicable)

- Declaration of Compliance with AML/CFT Requirements

Step 2: Submit the Application

Applications must be submitted to the Companies Registry along with the prescribed fees.

Step 3: Referral to the Police and Registrar of Companies

The application will be reviewed by:

- Companies Registry

- Hong Kong Police Force

These authorities will conduct background checks on the applicant, directors, and key personnel.

Step 4: Issuance of the Licence

After the court’s approval, the Companies Registry will issue the Money Lender’s Licence upon payment of the licence fee.

Processing Time & Fees

- The application process generally takes 3 to 6 months.

Compliance Requirements

Once licensed, money lenders must comply with:

- Money Lenders Ordinance (Cap. 163)

- Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615)

- Data Privacy and Consumer Protection Laws

- Annual Licence Renewal Requirements

Compliance Assistance

Given the complexity of the application and regulatory requirements, it is advisable to seek compliance services.

For assistance with your Money Lender’s Licence application in Hong Kong, you may contact:

Application for a Money Service Operator License and its renewal

Money Service Operator (MSO) is a person or an institution which operates a Money Changing service or a remittance service.

The service of money changing, as implied by its name, involves the exchange of different currencies. However, it is important to note that this excludes the common exchange of foreign currencies for local ones by tourists at hotel counters, which is regarded as “incidental.”

The term “remittance service” refers to the process of sending funds from Hong Kong to an overseas location or receiving funds in Hong Kong from abroad. This definition also encompasses any arrangements made for such sending or receiving of funds.

Money Changing Service means a service for exchanging of currencies that is operating in Hong Kong as a business, but does not include such a service that is incidental to the main business e.g. retail business accepting foreign currencies in transactions or that is operated by a person who manages a hotel if the service:

(a) is operated within the premises of the hotel primarily for the convenience of guests of the hotel;

(b) consists solely of transactions for the purchase by that person of non‐Hong Kong currencies in exchange for Hong Kong currency.

Remittance Service

Remittance Service means a service of one or more of the following that is operated in Hong Kong as a business:

(a) sending, or arranging for the sending of, money to a place outside Hong Kong;

(b) receiving, or arranging for the receipt of, money from a place outside Hong Kong;

(c) arranging for the receipt of money in a place outside Hong Kong.

Eligibility Requirements

To apply for an MSO licence, the applicant must:

- Be a company incorporated in Hong Kong

- Have a physical office in Hong Kong (virtual offices are NOT accepted)

- Ensure all directors, shareholders, and responsible persons are fit and proper

- Establish a compliance system to meet AML/CFT regulations

Application Process

Step 1: Prepare Required Documents

Applicants must submit the following:

- Application Forms

- A detailed Business Plan

- Business Registration Certificate

- Certificate of Incorporation (if applicable)

- Shareholder and Director Details

- AML/CFT Compliance Policies and Procedures

- Proof of Business Address (tenancy agreement, utility bills, etc.)

- Financial Statements or Business Plan

- Personal Information of Compliance Officer & Key Personnel

Content of the Business Plan

Item No. | Required information | Detail of the required information |

1 | Company name | Provide information on the company name, business name, website address, business logo and trademark. |

2 | Company history | Provide information on the applicant’s history, the source of capital and whether the applicant is associated with or controlled by any entities or group company. |

3 | Key executives of senior management | Provide information on the key executives of the senior management l. |

4 | Location of key management | Location of senior management. If there is any back-end office in or outside Hong Kong, elaborate the function of this office. |

5 | Customers and location of customers | Provide information on the potential and expected customers including their geographical location and nationality, mode of contacting with the customers etc. |

6 | Business operation in Hong Kong and its key objective | Elaborate in detail on what business operation will take place in Hong Kong and the reason of obtaining a licence locally. The business operation should detail the entire transaction process such as placing the transaction order, handling and processing of order, movement of funds, compliance function, and accounting and record keeping function, etc. |

7 | Delivery channels of product and service offered | Provide information on the type of product and service to be offered and the timeline of launching these product and service. Elaborate in detail on how each type of product and service are carried out and the entire delivery channel including processing of orders and fund flows going through each foreign agent or foreign MSO in different jurisdictions. If foreign agents or foreign MSOs are used to transfer or receive funds, please provide information on all agents and overseas MSOs . |

8 | Bank account | Provide information of any bank accounts used for the business, such as account number and owner of the bank account. Note: If the applicant considers there is no need to open bank account for the business, the applicant is required to provide details on how the company will provide money service without a bank account. |

9 | Profitability and financial information of the business | Provide information on the expected profit margin and turnover on each type of product and service for the next two years and the running capital for the daily operation of the business |

10 | Organizational structure | Organization of the group of companies in Hong Kong Elaborate the group of companies (include the parent company, local branches and subsidiaries), their locations and respective functions. Attach an organizational chart of the group.

Organization of the international group of companies outside Hong Kong Elaborate the international group of companies to which the applicant belongs. Attach an organizational chart of the international group. |

11 | Local business premises | If the applicant’s business premises are shared by “other businesses”, elaborate the nature of the “other businesses”, whether the business premises are also owned by the applicant/director or partner or staff of the applicant, and their business relationships with the applicant. If yes, elaborate the nature of the business relationships. |

12 | Local human resources | Management team of the applicant Elaborate the composition of the management team. Total number of the members, their position, roles and responsibilities,, the reporting lines.

Employee of the applicant Elaborate the composition of the employees. Total number of employees, their position, roles and responsibilities, the reporting lines.

|

13 | Use of outsourced services | Provide the name and nature of any outsourced services used by the applicant for AML/CFT purpose. For example, external audit function, any specified intermediary. |

14 | Computerized / screening systems | Elaborate the computerized systems and other automation systems used in the business.

For example, name of the commercial service or database provider for automated AML solution and sanction screening, etc. |

15 | Acting as agent or principal | If the applicant also acts as an agent for “other local MSO” or “overseas company/business entity”. Elaborate the functions of acting as agent by the applicant. If the applicant also acts as a principal for “other local MSO” or “overseas company/business entity”. Elaborate the functions of acting as principal by the applicant. |

16 | Other types of business relationships | If the applicant’s business involves the use of other third party’s payment platform or network, e.g. digital wallet, etc., explain the role of the payment platform / network in the applicant’s business. If the applicant’s business involves the activities of local/cross-boundary physical cash movement, provide the name of the company/person in relation to such activities. |

17 | Subject to other supervision | Whether the applicant’s local business or international group of companies to which the applicant belongs is also subject to other type of supervision (e.g. holding licence granted by other regulator/competent authority). If yes, provide the name of the other regulator/competent authority. |

Step 2: Submit the Application

Submit the application to the Hong Kong Customs and Excise Department (C&ED) along with the prescribed fee.

Step 3: Background Checks & Site Inspection

C&ED will conduct:

- Background checks on applicants, directors, and key personnel

- On-site inspection of the business premises

Step 4: Approval & Issuance of Licence

If the application is successful, the MSO Licence will be issued, valid for two years.

Compliance Requirements

Licensed MSOs must:

- Renew the licence every two years

- Maintain AML/CFT policies, conduct customer due diligence (CDD), and report suspicious transactions

- Submit annual returns and compliance reports

- Notify C&ED of any business changes (e.g., change of address, directors)

Processing Time & Fees

- The application process takes approximately 3–6 months.

- Fees depend on the number of branches and services offered.

Compliance Assistance

Due to strict regulatory requirements, professional assistance is recommended for preparing and submitting an MSO licence application.

For expert guidance, please contact: 📧 info@compliancefirst.com.hk

Trust or Company Service Providers (TCSPs) license application

Under the Anti‐Money Laundering and Counter‐Terrorist Financing Ordinance, Cap. 615 (“the AMLO”), a person commits an offence if the person carries on a trust or company service business in Hong Kong without a licence.

A Trust or Company Service Provider (TCSP) refers to an individual or business entity that provides services related to the formation, administration, and management of trusts, companies, and other legal arrangements. These services are often used for wealth management, estate planning, asset protection, and corporate structuring.

A trust or company service business means the business of the provision, in Hong Kong, by a person of one or more of the following services to other persons:

(a) forming corporations or other legal persons;

(b) acting, or arranging for another person to act—(i) as a director or a secretary of a corporation; (ii) as a partner of a partnership; or (iii) in a similar position in relation to other legal persons;

(c) providing a registered office, business address, correspondence or administrative address for a corporation, a partnership or any other legal person or legal arrangement;

(d) acting, or arranging for another person to act—(i) as a trustee of an express trust or a similar legal arrangement; or (ii) as a nominee shareholder for a person other than a corporation whose securities are listed on a recognized stock market.

A TCSP typically offers the following services:

- Company Formation & Registration – Assisting with the incorporation of companies and legal entities.

- Trust Formation & Administration – Establishing and managing trusts for estate planning and asset protection.

- Registered Office & Business Address Services – Providing a legal address for companies.

- Acting as a Director, Secretary, or Nominee Shareholder – Offering corporate governance services.

- Providing Trustee or Fiduciary Services – Managing assets on behalf of clients.

- Corporate Compliance & Secretarial Services – Ensuring adherence to legal and regulatory requirements.

- Nominee Service – A Nominee Service is a legal arrangement in which an individual or entity (the nominee) is appointed to act on behalf of the actual owner (the beneficial owner) of a company, shares, or other assets. This service is commonly provided by Trust or Company Service Providers (TCSPs) and is used for privacy, administrative convenience, and legal structuring.

Regulation and Compliance

Due to the potential risk of misuse in money laundering, tax evasion, and financial crimes, TCSPs are often regulated under Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. Many jurisdictions require TCSPs to be licensed or registered with regulatory authorities.

TCSP License Application Process

Eligibility Requirements

- The applicant (whether an individual or a company) must be fit and proper, meaning:

- No convictions related to money laundering, fraud, or dishonesty.

- No history of bankruptcy or insolvency.

- The applicant must maintain proper AML/CTF measures, including customer due diligence (CDD) and record-keeping.

Application Submission

- Submit the TCSP License Application Forms to the Companies Registry.

- Provide supporting documents, including:

- Business registration certificate.

- Information on directors, shareholders, and ultimate beneficial owners (UBOs).

- AML/CTF compliance policies and procedures.

- Pay the prescribed application fee (varies depending on the nature of the business).

Approval & License Issuance

- The Companies Registry will review the application and conduct background checks.

- If approved, the TCSP License is valid for 3 years, after which it must be renewed.

Compliance & Ongoing Obligations

Once licensed, TCSPs must:

✅ Maintain AML/CTF Policies – Conduct customer due diligence (CDD) and report suspicious transactions.

✅ Keep Proper Records – Retain client and transaction records for at least 5 years.

✅ File Annual Renewal Applications – Ensure the license remains valid.

✅ Notify the Companies Registry of Any Changes – Such as changes in company structure or compliance officers.

Penalties for Non-Compliance

Operating a TCSP business without a license in Hong Kong is a criminal offense and may result in:

❌ Fines up to HKD 100,000

❌ Imprisonment for up to 6 months

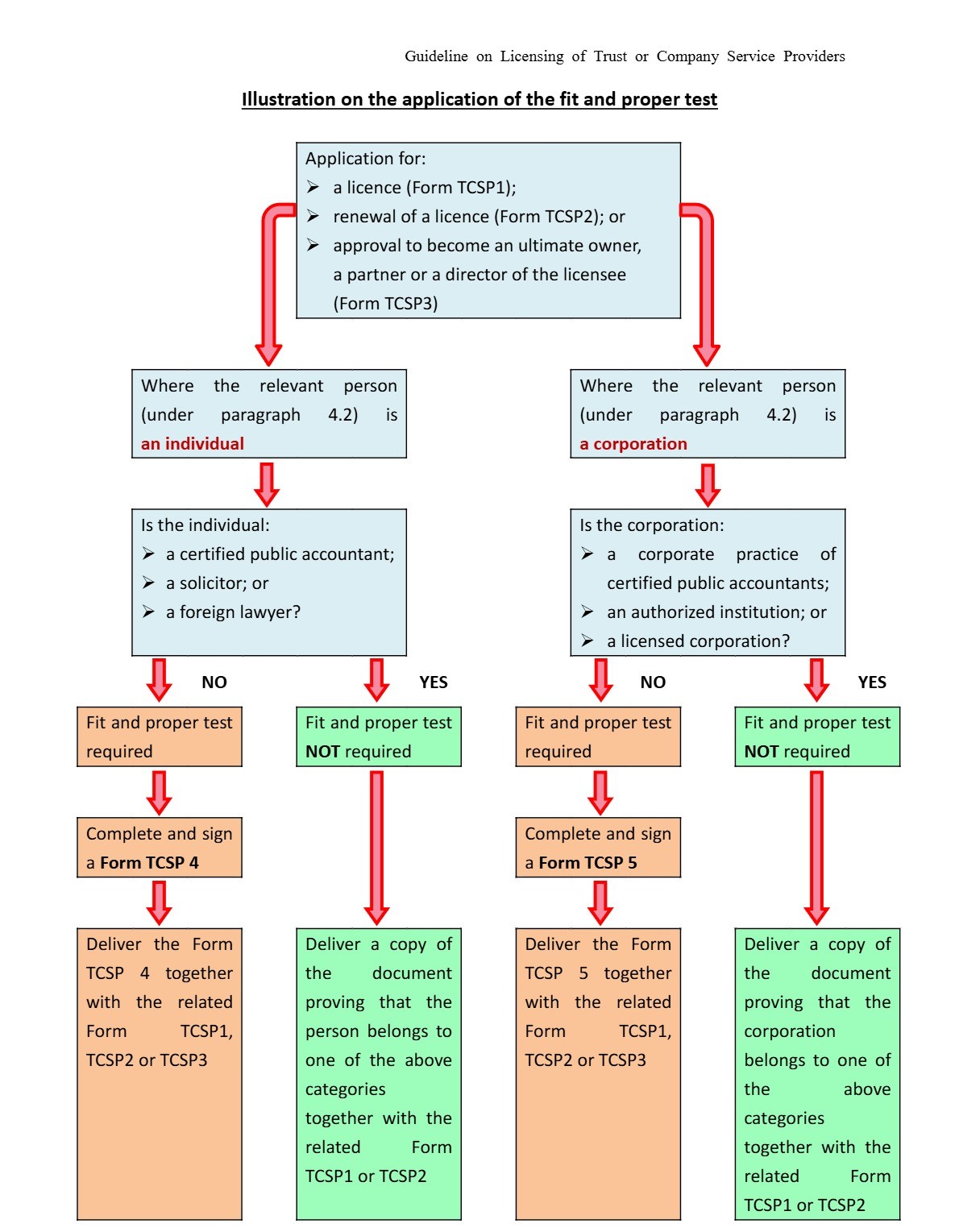

Please refer to below of the Application Process

Compliance Assistance

Due to strict regulatory requirements, professional assistance is recommended for preparing and submitting an TCSP licence application.

For expert guidance, please contact: 📧 info@compliancefirst.com.hk

All Licensed Corporations are subject to routine inspections by the SFC. These inspections are general checks on the firms’ systems and controls, as well as their compliance with the relevant rules and regulations, in the area(s) of relatively high importance.

Typically, before the inspection is due to commence, the inspection team will identify the key potential risk areas and formulate an inspection plan.

In most cases, a balanced top-down and bottom-up approaches are adopted in order to assess the overall effectiveness of a Licensed Corporation’s systems and controls for ensuring compliance with key legal and regulatory requirements applicable. This is achieved by:

- First gaining a high-level understanding of the Licensed Corporation’s business activities, operations, systems and controls, as well as future aspirations, based on information collected and analysis prepared as part of off-site monitoring work and through discussions with senior management; and

- Taking appropriate examination steps to ascertain how the Licensed Corporation’s systems and controls have been implemented in practice, such as:

- Performing walk-through tests on key control procedures and processes;

- Reviewing selected underlying documentation (such as bank and custodian);

- statements to confirm the existence and valuation of assets held);

- performing sample compliance tests; and

- Interviewing relevant staff to assess the control environment of the firm.

What Compliance First will do:

When Securities and Futures Commission (SFC) initiates an inspection—typically it will begin with a phone call. Compliance First will review the scope of the SFC’s inspection, which include entering premises to inspect, copy, record, and inquire about records, documents, transactions, and activities. The purpose of these inspections is to assess a licensee’s compliance with the SFO, statutory notices, regulatory requirements, and their licensing conditions. Compliance First emphasizes that the primary objective for licensees should be to navigate the inspection process efficiently and ensure a clean outcome without significant findings.

To achieve this, Compliance First provides practical guidance on preparation before the opening meeting, such as anticipating the SFC’s document request list, conducting effective meetings with SFC inspection team, briefing staff, and proactively identifying and addressing potential issues.

Compliance First regularly provides clients with support on SFC on-site inspections designed for management and / or staff. This support service covers what to expect, opening meetings, Dos and Don’ts List for SFC interviews and review of the documentation based on SFC’s document request list.

Compliance Assistance

For expert compliance support, please contact: 📧 info@compliancefirst.com.hk

Virtual Asset Trading Platform Operators Application under SFC

Under the Securities and Futures Ordinance (Cap. 571) (SFO) and the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) (AMLO), centralized virtual asset trading platforms (“VATP”) carrying on their businesses in Hong Kong, or actively marketing their services to Hong Kong investors, are required to be licensed and regulated by the SFC.

Currently, VATPs are licensed under the Securities and Futures Ordinance (Cap 571) (“SFO Regime”) and are required to obtain SFC Type 1 and Type 7 licenses. The SFC proposes that the SFO Regime will be consolidated with the VASP Regime under AMLO, and that the VATP Guidelines will be applicable to all VATPs under the SFO Regime or the new VASP Regime under AMLO.

What do you need before submitting the Application to HKSFC

VATP applicants will be required to submit external assessment reports to the SFC for their VATP license application.

(a) Conduct a gap analysis of its existing structure, governance, operations, systems and controls to identify areas that need enhancement to comply with the regulatory requirements;

(b) Implement any necessary enhancements, including any changes required to financial resources, custody arrangements, personnel, policies, documentation etc.;

(c) Incorporate a wholly-owned subsidiary to act as the VATP Operator’s associated entity for the purpose of holding client assets and apply to the Registrar of Companies to licence such associated entity as a trust or company services provider (TCSP) under the AMLO; and

(d) Engage an external assessor to prepare an External Assessment Reports

Scope of External Assessment Reports

- Each VATP operator applicant under the existing SFO regime and/or the AMLO VASP regime is required to submit an external assessor report when submitting its VATP licence application. The external assessor ‘s assessment report is performed as a direct assurance engagement and it must be signed off by a Practising Certified Public Accountant (CPA).

Some of the more significant requirements are summarized below.

Minimum financial resources requirements

A Licensed VATP Operator must maintain at least HK$5 million of paid-up share capital and at least HK$3 million of liquid capital.

Requirements for responsible officers and executive directors

An applicant must appoint at least two Responsible Officers (ROs) in relation to the VATP services. Each RO must be “fit and proper” and must meet minimum experience requirements.

At least one RO must be on the board of directors of the Licensed VATP and actively participates in or be responsible for directly supervising the VATP service (such person is known as an Executive Director). Every individual Executive Director must be approved by the SFC as a RO. Board members do not have the option of being approved as licensed representatives only, because of their inherent seniority.

At least one RO must be available at all times to supervise the VATP operator’s business. At least one RO must ordinarily reside in Hong Kong.

Establishment of token admission and review committee

A Licensed VATP Operator must establish a Token Admission and Review Committee. The Committee is responsible for setting the criteria for virtual assets to be admitted to trading, the criteria for suspending and withdrawing virtual assets from trading; determining whether to admit, suspend or withdraw virtual assets from trading, imposing requirements on virtual asset issuers that are listed on the VATP and conducting regular reviews of these criteria and requirements.

Implement a market surveillance system

A Licensed VATP Operator must adopt a market surveillance system to identify, monitor, detect and prevent any market manipulative or abusive activities on its VATP. The market surveillance system must be provided by a reputable and independent provider.

Custody requirements

A Licensed VATP Operator must establish an “associated entity” to hold client assets. The associated entity must:

(a) be a company incorporated in Hong Kong;

(b) be a wholly-owned subsidiary of the VATP operator;

(c) be licensed by the Registrar of Companies as a TCSP;

(d) hold client assets on trust; and

(e) not conduct any business other than that of receiving or holding client assets on behalf of the VATP operator.

At least 98% of client virtual assets should be held in cold storage at all times, except to the extent the SFC agrees otherwise on a case-by-case basis.

All seeds and private keys (and their backups) must be securely stored in Hong Kong.

Insurance or other compensation arrangements for potential losses

A Licensed VATP Operator must have a compensation arrangement to cover potential losses, including potential losses arising from hacking incidents, theft, fraud or default. The compensation arrangement must cover potential losses of 50% of client virtual assets in cold storage and 100% of client virtual assets in hot and other storages.

The compensation arrangement can consist of one or a combination of the following:

(a) Third-party insurance;

(b) Funds (held in the form of a demand deposit or time deposit which will mature in 6 months or less) or virtual assets of the VATP operator or any corporation within the same group of companies as the VATP Operator which are set aside on trust and designated for such a purpose; and

(c) Bank guarantee provided by an Authorized Financial Institution in Hong Kong.

The SFC must approve the compensation arrangement, and any changes to the compensation arrangement.

Application method

The application must be made online through the SFC’s WINGS platform.

Application fees

A licence applicant must pay application fees to the SFC. Currently, the fees are HK$4,740 for the VATP operator itself, HK$2,950 for each proposed responsible officer and HK$1,790 for each licensed representative. Additional fees apply if the applicant applies to be licensed under the SFO as well.

What activities does the VATP licence permit?

Permitted activities

A Licensed VATP Operator can offer trading in virtual assets to “professional investors” (as defined in the SFO). A Licensed VATP Operator can also offer trading in certain virtual assets to retail investors.

Prohibited activities

A Licensed VATP Operator cannot:

- provide financial accommodation to its clients to acquire virtual assets (i.e. margin trading is not permitted);

- offer, trade or deal in virtual asset futures contracts or related derivatives;

- provide algorithmic trading services for its clients;

- make any arrangements with its clients to use client virtual assets held by the VATP Operator for the purpose of generating returns for the clients or any other parties (i.e. lending, borrowing, staking etc.);

- engage in proprietary trading or market making on a proprietary basis.

Ability to offer virtual assets to retail investors

A Licensed VATP Operator can offer trading in eligible large-cap virtual assets to retail investors.

“Eligible large-cap virtual assets” refer to virtual assets which are included in a minimum of two “acceptable indices” issued by at least two independent index providers. An index provider may only be considered independent if it does not belong to the same entity or is not within the same group of companies as the issuer of the virtual asset or the Licensed VATP Operator.

An “acceptable index” is an index which has a clearly defined objective to measure the performance of the largest virtual assets in the global market and fulfils the following criteria:

(a) The index should be investible, meaning the constituent virtual assets should be sufficiently liquid;

(b) The index should be objectively calculated and rules-based;

(c) The index provider should possess the necessary expertise and technical resources to construct, maintain and review the methodology and rules of the index; and

(d) The methodology and rules of the index should be well documented, consistent and transparent.

At least one of the indices must be issued by an index provider which complies with the IOSCO Principles for Financial Benchmarks and has experience in publishing indices for the conventional securities market.

The SFC may permit a Licensed VATP Operator to offer trading in other virtual assets to retail investors on a case-by-case basis.

What are the ongoing licence obligations?

A Licensed VATP Operator will need to:

(a) ensure ongoing compliance with regulatory requirements under the AMLO;

(b) at all times comply with financial resources requirements for minimum paid-up share capital and minimum liquid capital;

(c) make various ongoing regulatory filings with the SFC, including financial resources returns, annual returns and annual business risk management questionnaire;

(d) make various ad hoc regulatory filings with and applications to the SFC, including as a result of changes to personnel, ultimate owners and scope of business activities;

(e) ensure its representatives receive ongoing training; and

(f) promptly report incidents of material breach or non-compliance with regulatory requirements to the SFC.

What Compliance First can assist with the pre-application and final application to SFC:

- Incorporate a wholly-owned subsidiary to act as the VATP operator’s associated entity for the purpose of holding client assets and apply to the Registrar of Companies to licence such associated entity as a trust or company services provider (TCSP) under the AMLO

- Compliance First provides expert assistance in designing, drafting, and implementing key policies for Virtual Asset Trading Platform (VATP) applicant, ensuring compliance with regulatory requirements.

We assist with the design and compilation of the following policies:

- Governance and Staffing Controls/Policies

- Token Admission Controls/Policies

- Custody of Virtual Assets (VA) Controls/Policies

- Cybersecurity Controls/Policies

- Know Your Client (KYC) Policy and Ongoing Monitoring Procedures

- Anti-Money Laundering (AML) Policy and Relevant Ongoing Monitoring Procedures

- Trading System & Risk Management Policy

- Market Surveillance Controls/Policy

Additionally, Compliance First guides VATP Operator license applicants in:

✔ Implementing and ensuring the effective adoption of planned policies, procedures, systems, and controls.

✔ Conducting interviews with external assessors as part of the external assessment process.

Submitting the application to SFC

- Prepare all application forms through the SFC’s WINGS platform.

- Handle all correspondence and exchanges with the SFC, including responding to follow-up questions and preparing additional materials as required.

For professional compliance support, please contact: 📧 info@compliancefirst.com.hk

Licensing Conditions Imposed by the SFC on Licensed Corporations

The Hong Kong Securities and Futures Commission (SFC) may impose various licensing conditions on licensed corporations (LCs) to ensure compliance with regulatory requirements and investor protection measures. These conditions vary depending on the nature of the business, associated risks, and the firm’s operational capabilities.

The most common licensing conditions:

- The licensee shall only provide services to professional investors. The term “professional investor” is as defined in the Securities and Futures Ordinance and its subsidiary legislation.

- The licensee shall not hold client assets. The terms “hold” and “client assets” are as defined under the Securities and Futures Ordinance.

- With respect to providing virtual asset dealing services, the licensee or registered institution shall only provide such services to persons which are, and remain at all times, its clients in respect of its business in Type 1 regulated activity (dealing in securities). The term “dealing in securities” is specified in Part 2 of Schedule 5 to the Securities and Futures Ordinance. The term “virtual asset” is defined in section 53ZRA of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

- With respect to providing virtual asset advisory services, the licensee or registered institution shall only provide such services to persons which are, and remain at all times, clients of the licensed corporation or registered institution in respect of its business in Type 4 regulated activity (advising on securities). The term “advising on securities” is specified in Part 2 of Schedule 5 to the Securities and Futures Ordinance. The term “virtual asset” is defined in section 53ZRA of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

- With respect to introducing clients to virtual asset trading platform operators, the licensee or registered institution shall only engage in the introduction of persons to establish accounts with an SFC-licensed virtual asset trading platform (SFC-licensed platform) to effect dealing in or make offers to deal in virtual assets directly. The licensee or registered institution shall not communicate any offers to effect dealings in virtual assets to the SFC-licensed platform. Prior to introducing clients to establish accounts with an SFC-licensed trading platform, the licensee or registered institution should enter into a written client agreement with clients which should set out a clear description of the nature of the services to be provided to or available to the client, including the role and obligation of the licensee or registered institution and that it would not provide any dealing, financial accommodation, settlement or custody services. The term “SFC-licensed platform” means a virtual asset trading platform operator which is licensed by the SFC pursuant to section 116 of the Securities and Futures Ordinance and/or section 53ZRK of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO). The term “virtual asset” is defined in section 53ZRA of the AMLO.

- With respect to introducing clients to virtual asset trading platform operators, the licensee or registered institution shall only introduce persons which are professional investors and are its clients in respect of its business in Type 1 regulated activity (dealing in securities). The term “professional investor” is defined in section 1 of Part 1 of Schedule 1 to the Securities and Futures Ordinance (SFO) together with the Securities and Futures (Professional Investor) Rules. The term “dealing in securities” is specified in Part 2 of Schedule 5 to the SFO.

- With respect to introducing clients to virtual asset trading platform operators, the licensee or registered institution shall not hold client assets. • The term “hold” is as defined under the Securities and Futures Ordinance; and • The term “client assets” means: (i) “client virtual assets”, which means any virtual assets received or held by the licensee or registered institution, which are so received or held on behalf of a client or in which a client has a legal or equitable interest, and includes any rights thereto. The term “virtual asset” is defined in section 53ZRA of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance; and (ii) “client money”, which means any money received or held by the licensee or registered institution, which is so received or held on behalf of a client or in which a client has a legal or equitable interest, and includes any accretions thereto whether as capital or income.

- With respect to providing virtual asset dealing services, the licensee or registered institution shall only provide such services through operating an omnibus account established and maintained with an SFC-licensed platform. The term “SFC-licensed platform” refers to a virtual asset trading platform operator which is licensed by the SFC pursuant to section 116 of the Securities and Futures Ordinance and/or section 53ZRK of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO). The term “virtual asset” is defined in section 53ZRA of the AMLO.

- With respect to providing virtual asset dealing services, the licensee or registered institution shall comply with the “ Terms and conditions for licensed corporations or registered institutions providing virtual asset dealing services under an omnibus account arrangement ” (as amended from time to time). The term “virtual asset” is defined in section 53ZRA of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

- With respect to providing virtual asset advisory services, the licensee or registered institution shall comply with the “Terms and conditions for licensed corporations or registered institutions providing virtual asset advisory services” (as amended from time to time). The term “virtual asset” is defined in section 53ZRA of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

- With respect to providing virtual asset related asset management services, the licensee or registered institution shall comply with the “Terms and conditions for licensed corporations or registered institutions which manage portfolios that invest in virtual assets ” (as amended from time to time). The term “virtual asset” is defined in section 53ZRA of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

- The licensee shall comply with all requirements applicable to it as a custodian in respect of an open-ended fund company, including the requirements set out in the Code on Open-ended Fund Companies and related guidance issued and revised by the Commission from time to time.

- For Type 9 regulated activity, the licensee shall not provide a service of managing a portfolio of futures contracts for another person.

- For Type 9 regulated activity, the licensee shall not conduct business involving the discretionary management of any collective investment scheme. The term “collective investment scheme” is as defined under the Securities and Futures Ordinance.

- For Type 1 regulated activity, the licensee shall not engage in dealing activities other than those relating to corporate finance.

- For Type 6 regulated activity, the licensee shall not advise on matters/transactions falling within the ambit of the Codes on Takeovers and Mergers and Share Repurchases issued by the Commission.

- For Type 9 regulated activity, the licensee shall not conduct business involving the discretionary management of any collective investment scheme. The term “collective investment scheme” is as defined under the Securities and Futures Ordinance.

- For Type 6 regulated activity, the licensee shall only provide services to professional investors. The term “professional investor” is as defined in the Securities and Futures Ordinance and its subsidiary legislation.

- For Type 6 regulated activity, the licensee shall not act as sponsor in respect of an application for the listing on a recognized stock market of any securities.

- For Type 6 regulated activity, the licensee must, in the capacity as an adviser to a client on matters/transactions falling within the ambit of the Codes on Takeovers and Mergers and Share Buy-backs issued by the Commission, act together with another adviser (to the client) not subject to this condition.

- For Type 9 regulated activity, the licensee shall only carry on a business in the management of: (a) discretionary accounts; and (b) collective investment schemes that are offered to professional investors only. The terms “collective investment scheme” and “professional investor” are defined under the Securities and Futures Ordinance and its subsidiary legislation (where applicable).

- With respect to providing virtual asset related asset management services, the licensee or registered institution shall comply with the “Terms and conditions for licensed corporations or registered institutions which manage portfolios that invest in virtual assets ” (as amended from time to time). The term “virtual asset” is defined in section 53ZRA of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

Compliance First can assist in applying for the modification of licensing conditions, whether you need to uplift existing restrictions or add new conditions to better align with your business scope and operational needs. Please contact: 📧 info@compliancefirst.com.hk

USA Internal Revenue Service – Qualified Intermediary Application

Recently, Brokers in Hong Kong are required to apply a SFC- Type 1 licensed corporation to apply for a Qualified Intermediary (QI) status with the U.S. Internal Revenue Service (IRS) to comply with U.S. tax regulations when they involve in dealing with US securities.

Background on Qualified Intermediary (QI) Status

- A Qualified Intermediary (QI) is a financial institution that enters into an agreement with the IRS to withhold and report U.S. tax on behalf of its clients.

- QIs help foreign investors comply with U.S. tax regulations, particularly regarding U.S. source income (e.g., dividends from U.S. stocks).

Why Does Brokers in Hong Kong require a HKSFC Type 1 licensed corporation?

- Regulatory Compliance: Brokers in Hong Kong which handles US securities shall comply both Hong Kong and U.S. tax laws and thus require a SFC-Type 1 license.

- Withholding Tax Obligations: Under IRS rules, foreign brokers handling U.S. securities need to ensure proper tax withholding and reporting.

- Local Licensing Requirements: intermediaries (such as banks or brokerage firms) may be required to be locally licensed with the Securities and Futures Commission (SFC) of Hong Kong before becoming a QI.

- Risk Management: By working with licensed intermediaries, only regulated entities with a QI status is competent to handle U.S. securities trades.

More Information on IRS Form W-8

All non-US persons and entities are required to complete an IRS Form W-8 to certify your country of tax residence and to establish whether you qualify for a reduced rate of withholding when opening an account. The type of W-8 form completed depends on the whether or not you open an individual account or an entity account. W-8 Forms are not provided to the IRS.

Valid W-8 Forms

Forms W-8 are valid for the year in which they are signed and for the next three calendar years.

Tax withholding determination:

Generally, tax is withheld at a rate of 30% on payments of US source stock dividends and substitute payments in lieu. The rate of withholding may be reduced if there is a tax treaty between your country of tax residence and the US

US Tax withholding on distributions from Publicly Traded Partnerships is withheld at 37% (2018) as this is earned income in the US

Updating Form W-8:

Forms W-8 are valid for the year in which they are signed and for the next three calendar years. Failure to update your W-8 form will result in withholding on all income including gross proceeds from securities sales.

Requirement to Complete Form W-8:

Form W-8, Certificate of Foreign Status, must be on file with the Intermediary. This form must be renewed every three years. If the form W-8 is no longer valid, the Intermediary will assume that you are a non-US person and withhold US tax at 30% on interest, dividends, gross proceeds and payments and lieu. Treaty rates, if applicable, will no longer apply.

Note that if you complete Form W-8 you will not receive a Consolidated Form 1099, but you may receive Form 1042S.

Withholding Penalty

If you fail to provide a Form W-8, or do not resubmit a new W-8 when prompted upon the three-year expiration, additional withholding will apply.

Compliance First assists with our financial intermediaries or financial institutions to apply for QI status. Please contact: 📧 info@compliancefirst.com.hk